With the growth of social movements both nationally and globally, more Canadian consumers are calling on brands to play a bigger role in supporting issues of diversity and equality. This is particularly true among Gen Z shoppers, a consumer group gaining in purchasing power and more likely to identify as LGBTQIA+. How can brands ensure their social initiatives resonate with and are responsive to the issues LGBTQIA+ consumers face?

Understanding LGBTQIA+ consumers and the ways brands can best engage them is the focus of a recent webinar from Numerator Canada’s New Frontiers series, which explores emerging trends. In this latest analysis leveraging Numerator Insights and Survey data, we take an in-depth look at the purchasing patterns and perspectives of the LGBTQIA+ shopper and share steps brands and retailers can take to demonstrate their sincere support as allies in the marketplace.

The Trend-Seeking and Trendsetting Traits of the LGBTQIA+ Consumer

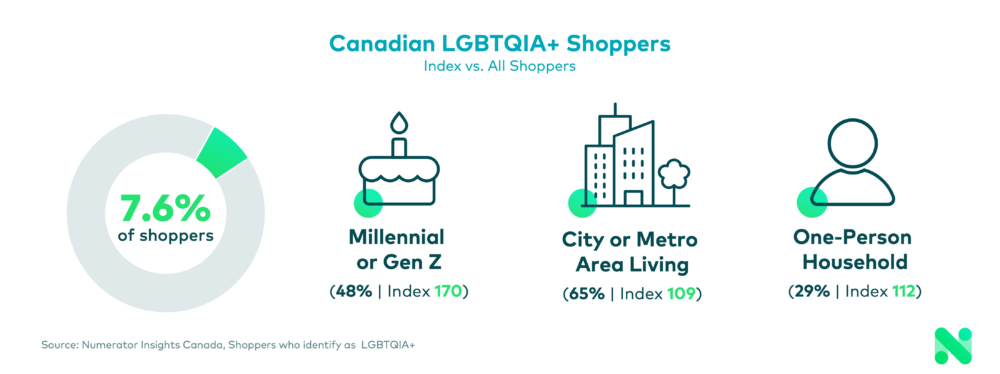

Our latest survey found that 7.6% of Canadian consumers identify as LGBTQIA+, contributing $19 billion in annual sales. To put that percentage into perspective, the LGBTQIA+ consumer group is larger than Atlantic Canadians or residents of Saskatchewan and Manitoba. The group skews toward young, educated, city-dwellers from smaller households.

Additionally, LGBTQIA+ shoppers are trendsetters, driven by their values as well as their commitment to wellness and an active lifestyle. They over-index in certain beverage categories, preferring niche brands of sports drinks, fruit juices, and coconut or flavored water over mainstream brands. And their pursuit of healthy living translates into shopping carts populated with more organic and health-oriented products like fruit smoothies, meat alternatives, kombucha, and quinoa, all categories that have become more mainstream in recent years, making LGBTQIA+ consumers an important bellwether for new trends.

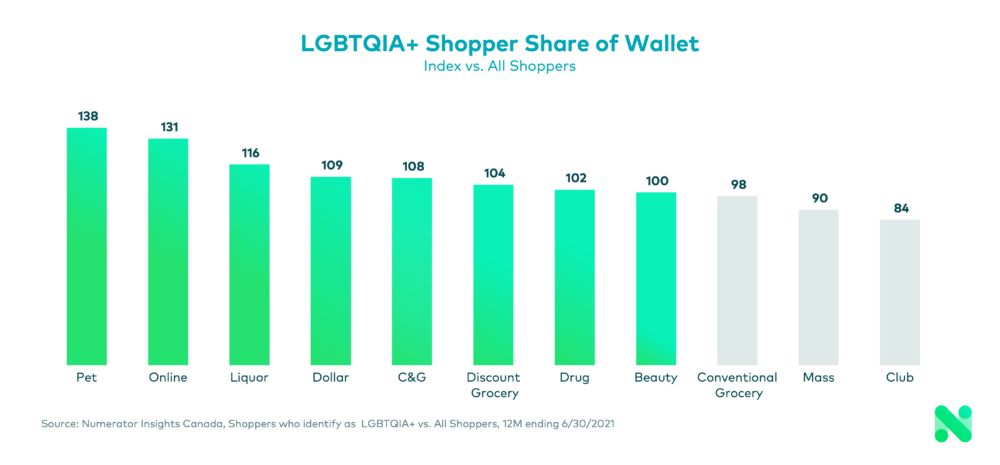

Larger Share of LGBTQIA+ Dollars Directed at Online and Specialty Retailers

LGBTQIA+ consumers spend a larger portion of their dollars in the Pet, Online, and Liquor channels, choosing to stock up at specialty retailers rather than stores in Mass and Club. In fact, even though LGBTQIA+ consumers spend the same amount annually on alcoholic beverages as the average Canadian household, their BevAlc purchases are more likely to be made at Liquor stores than at traditional grocery chains. It’s also worth noting that during Pride Month in June, Beauty and Conventional Grocery channels saw an increase in LGBTQIA+ purchases, a shift likely influenced by the upswing in events and social gatherings.

LGBTQIA+ consumers are online, shopping at ecommerce retailers and using social media, so brands and retailers need messaging that reaches these shoppers on popular platforms, especially Twitter. In-store promotions have a role to play as well, since LGBTQIA+ consumers tend to browse retailer displays and make impulse purchases.

Brands Backing Pride Boost Perception and Purchases Among LGBTQIA+ Shoppers

When brands and retailers show support for Pride in their marketing, the LGBTQIA+ community takes notice. This year, 80% of LGBTQIA+ shoppers said they saw retail advertising and promotional materials make a point to honour Pride Month, and 64% feel brands and stores are doing a better job at representing their community than in prior years. These demonstrations of support are crucial, because 75% of Canadian LGBTQIA+ shoppers believe brands and retailers have the power to make a difference in society, and they’ll reward those stores and brands who are visibly supportive with their trust and their wallets as a result.

Brand Initiatives Need to Move Beyond Pride and Drive Year-Long Change

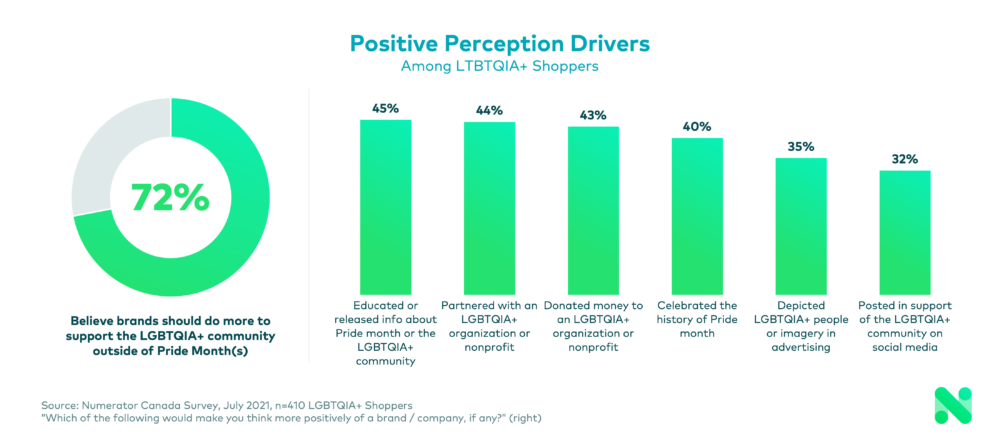

While the overall sentiment of LGBTQIA+ consumers toward brands’ Pride initiatives is mostly positive, an underlying sense of skepticism lingers. Why? Almost two-thirds of these shoppers question the sincerity of these initiatives, believing Pride has become too corporate. Among the LGBTQIA+ community, there is concern brands are simply “rainbow washing,” using Pride as a marketing gimmick to sell products instead of authentically supporting the community.

Pride needs to be more than a promotional display or rainbow-themed product, and 72% of LGBTQIA+ shoppers would like to see brands extend their support beyond Pride Month. To overcome remaining misgivings and generate goodwill with the LGBTQIA+ community, brands need to incorporate year-long initiatives into their strategy, such as partnering with or donating to LGBTQIA+ organizations and sharing educational information. This will go a long way to improving how brands are perceived in the community, especially among younger members.

Looking Ahead

As LGBTQIA+ consumers grow in purchasing power, they are seeking out products and places that make them feel seen and supported. Brands and retailers who commit to supporting the LGBTQIA+ community through meaningful and impactful initiatives both during Pride Month and throughout the year are more likely to be viewed as authentic and win the trust and loyalty of these consumers.

We invite you to listen to the webinar replay for additional details on how to authentically support LGBTQIA+ consumers. To learn more about how your LGBTQIA+ buyers and their behavior, reach out to your Numerator Consultant or contact us.